35+ Va student loan payment calculation

75300 ¼ time or less. Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff.

Scholarships Student Financial Services Liberty University

These loans are more expensive and have higher origination costs than a standard mortgage VA loan or FHA loan making them impractical as a personal loan for most borrowers.

. Section 102635a1ii provides a separate threshold for determining whether a transaction is a higher-priced mortgage loan subject to 102635 when the principal balance exceeds the limit in effect as of the date the transactions rate is set for the maximum principal obligation eligible for purchase by Freddie Mac a jumbo loan. Less than ½ time and more than ¼ time. For each of those years it will index your income for inflation and include it up to the taxable maximum the point at which you stop paying Social Security taxes.

If the number of units is four or more you are to multiply the total VA by 075 and enter the product in line 8. The total interest paid and the total amount of payment made throughout the life of the loan. Your tax bracket depends on your taxable income and your filing status.

Whether applying for a car loan or a mortgage youll need a good credit score. Indicate the Load of Other Equipment. VA Student Loan Guidelines 2022.

Citizenship status 14Examples of eligible noncitizen categories are given in the FAFSA instructions and a detailed discussion of citizenship issues can be found in Volume 1. However other students can still submit the FAFSA because they might be eligible for aid from. If you check the Yes.

Amounts owed 30 of credit score Payment history 35 of credit score. What to include in your DTI math. Mortgage Calculators FHA Loan Calculator VA.

My income is only 17Kyear and I would need an income of about. 10 12 22 24 32 35 and 37. VA may pay Federally insured student loans as an incentive for candidates or current employees of the agency to attract andor retain highly qualified employees.

A much lower interest rate than most other loans or debts that you may have such as credit cards personal loans or student loans. If your payment is based on a calculation that pays off your loan in full at the end of the loan term this is an amortized payment. Mortgage Prepayment Calculator to calculate early payoff for your mortgage payments based on a desired monthly payment or the number of years until payoff.

You may be eligible for several types of VA education and training benefits but there are many things to consider before you apply for a GI Bill program. If the local HR management office approves a student loan repayment the local payroll staff will receive a signed copy of the service agreement and specific information payment. Citizens or certain classes of noncitizens are eligible for Title IV aid.

Like in the preceding section you are to select either the Yes or No box. However its quarterly income was comparable the previous three quarters and was 6. For most participants the Post-911 GI Bill is the best option.

This free mortgage training video discusses 2019 Loan Limits for VA 2019 Loan Limits for FHA and more. Having a car loan on your credit file will impact the following. I have a Parent Plus Loan with my daughter at 58k but my IBR once I consolidate will be 000.

FHLMC_ Student Loan Payment Calculation Updates - Part 2. Your back-end DTI ratio includes payments you make on all of your loan obligations including your credit cards housing payment and auto loan as well as any other legally obligated payments such as alimony and child support. Down 35 percent from the 72 billion it earned in the second quarter of 2021.

The first step is calculating your average indexed monthly earnings AIME. There are two types of DTI ratios back end and front end. Typically lenders look for a minimum credit score of 620 for conventional loans and 580 for FHA or VA loans.

The Social Security Administration SSA will take your 35 highest-earning years into consideration. There are seven tax brackets for most ordinary income for the 2021 tax year. Other students would benefit more from the Montgomery GI Bill.

A hard money loan uses the value of a property as the collateral but often with untenable terms.

Free 9 Sample Employee Loan Agreements In Pdf Ms Word

2

2

35 Fact Sheet Templates Pdf Doc Apple Pages Google Docs Fact Sheet Word Template Words

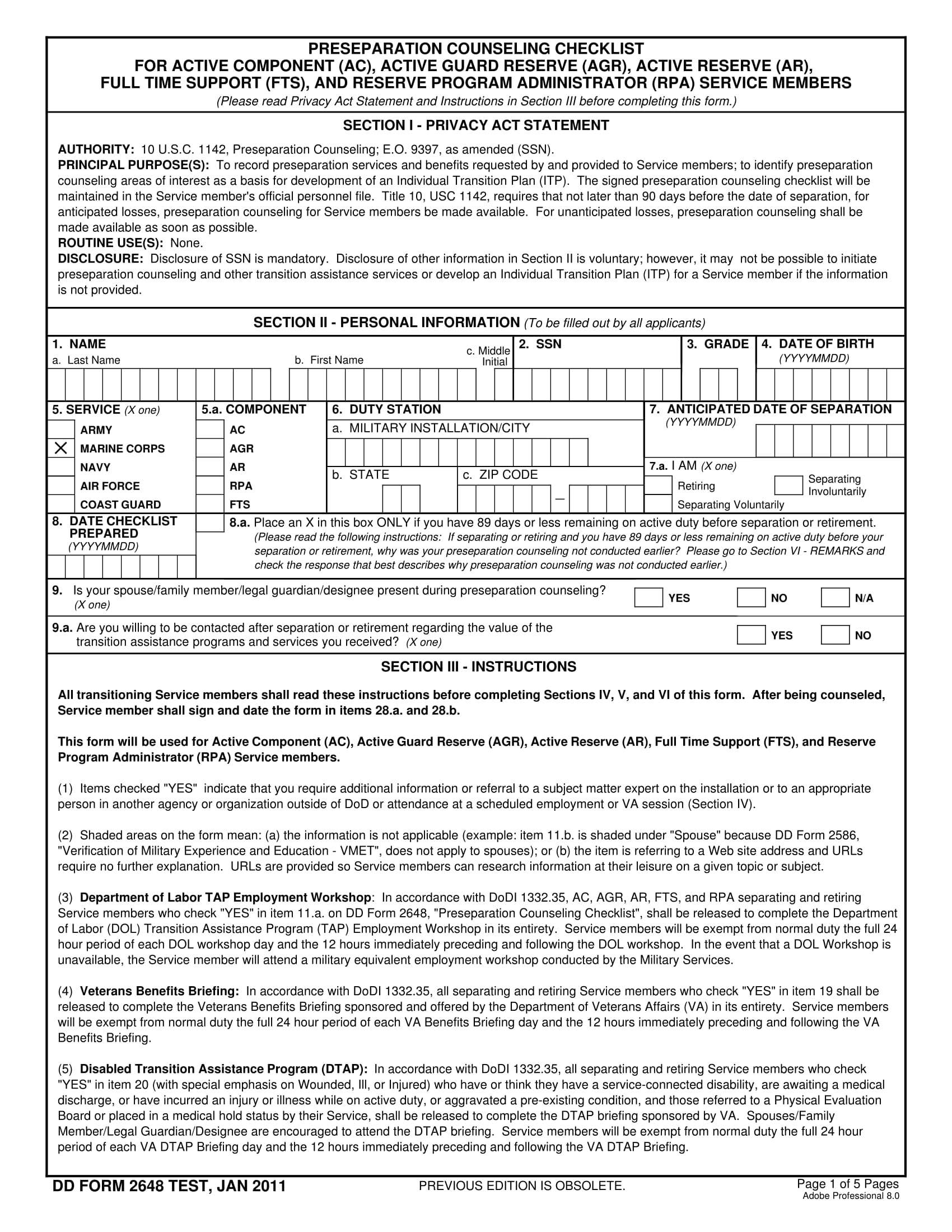

Free 14 Counseling Statement Forms In Pdf

1

Image 035 Jpg

1

1

2

2

2

Classified Annals Of Emergency Medicine

Free Printable Debt Payoff Coloring Page Credit Card Debt Payoff Credit Card Tracker Credit Card Interest

2

2

3