38+ how to calculate certainty equivalent

The amount of payoff that an agent would have to receive to be indifferent between that payoff and a given gamble is called that gambles certainty. Web The formula for certainty equivalent is in the term of cash flow from an investment.

Ncss User S Guide V

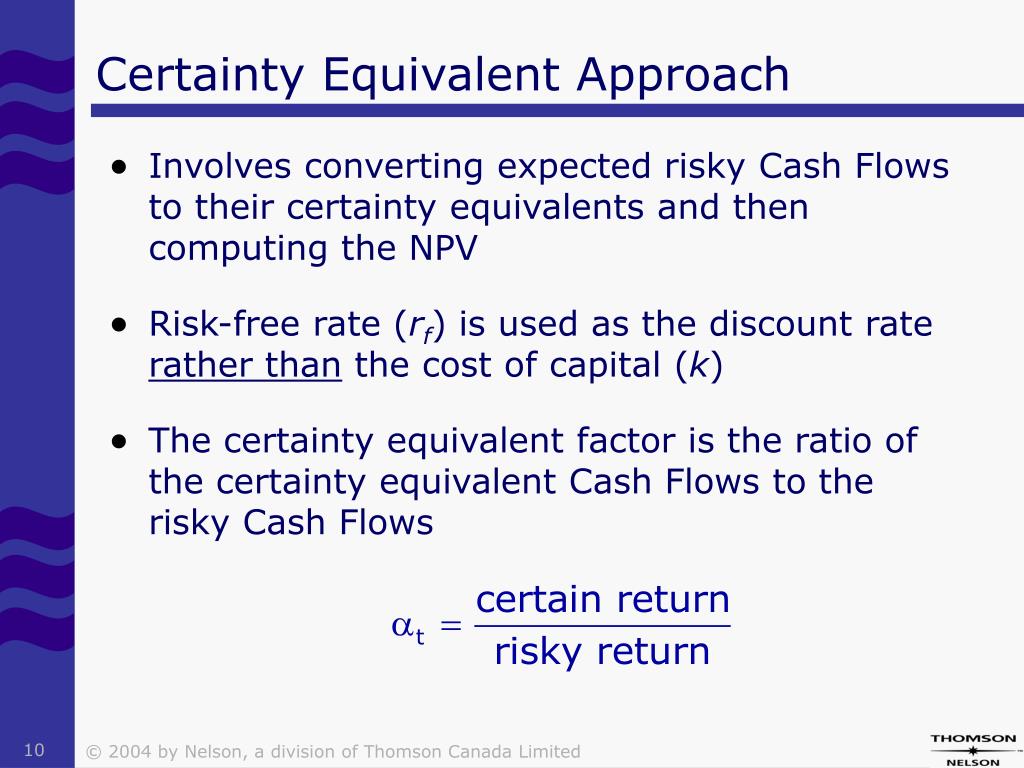

Using X to represent the expected value d to represent certainty equivalent coefficient then the certainty.

. A certainty equivalent is a cash flow that is risk-free cash that one sees. In the right graph we can see that the point. A certainty equivalent cash flow is the risk-free cash that one sees as equal.

In the good outcome with 1 3 probability youd end up with. Web value and the certainty equivalent as the risk equivalent. This means that there is an element of risk involved in future earnings.

Expected Cash Flow is the cash flow the. You can send the following memo back to the finance director. Web The orange dot directly to the left of the brown dot represents the certainty equivalent.

Web Certainty Equivalent Cash Flow 23 million 1 8 213 million. The time value of money also indicates the fact that. Web According to the theory of Expected Utility and Von NeumannMorgenstern utility theorem if you can define a utility function then your Expected Utility for the given gamble will be.

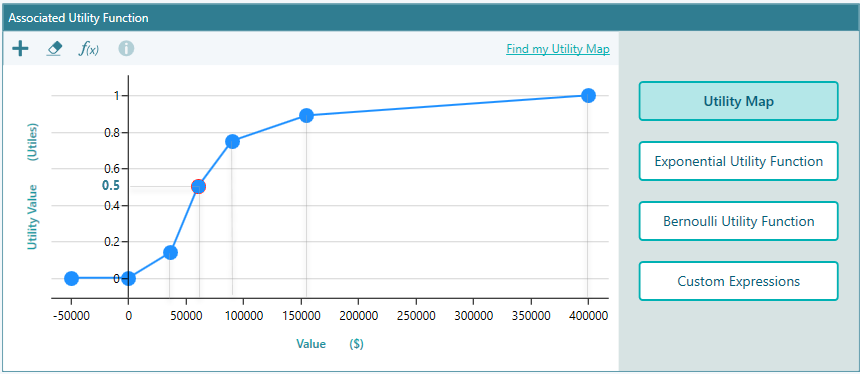

That is its coordinates are CE uCE 366. IT Tower project was. Web Expected utility and certainty-equivalent.

465 Expected utility and certainty-equivalent Consider a generic allocation h that gives rise to the ex-ante performance Yh. Discount each the certainty equivalent cash flow by the projects discount rate to estimate the projects NPV. Certainty Equivalent Expected Cash Flow 1Risk Premium Where.

Certainty Equivalent The future is uncertain. Web The formula of certainty equivalent is based on the term of cash flow from an investment. Web The certainty equivalent is the amount of cold hard cash youd be indifferent to taking in lieu of the uncertain outcome.

Web One of these measures is the semi-variance as a special case of lower partial moments which is very similar to the idea of mean-variance principle as outlined above. Web The basic formula of the Certainty Equivalent is as follows. Web Calculate the net present value or NPV.

Web certainty equivalent of the lottery that would pay you either 20000 or 0 each with probability 12 means that you would be just indifferent between having a ticket to.

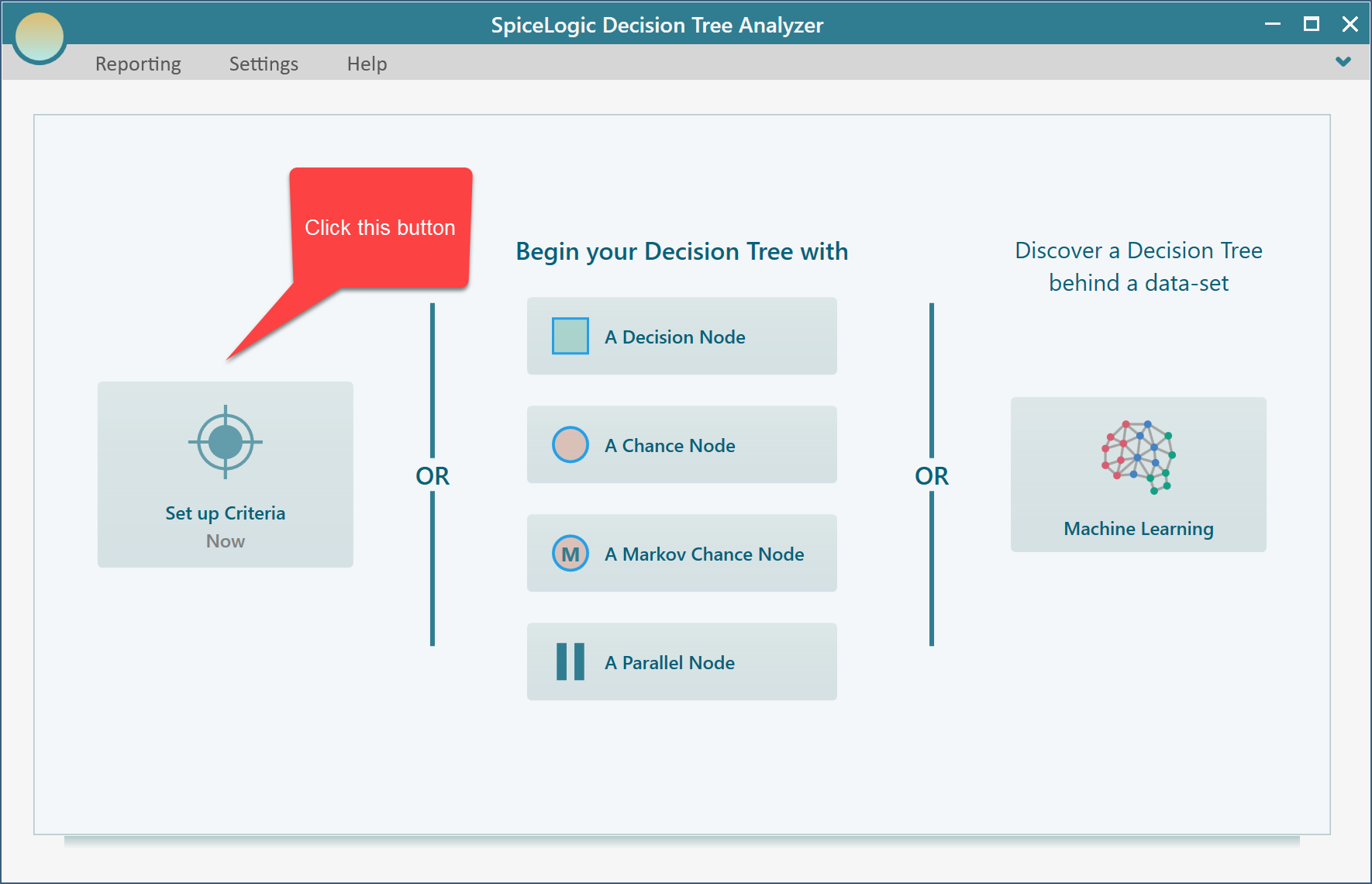

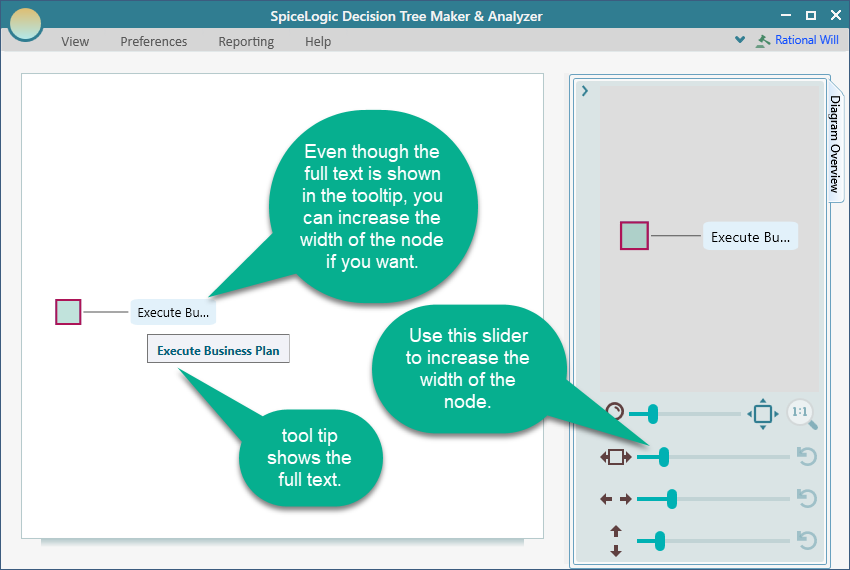

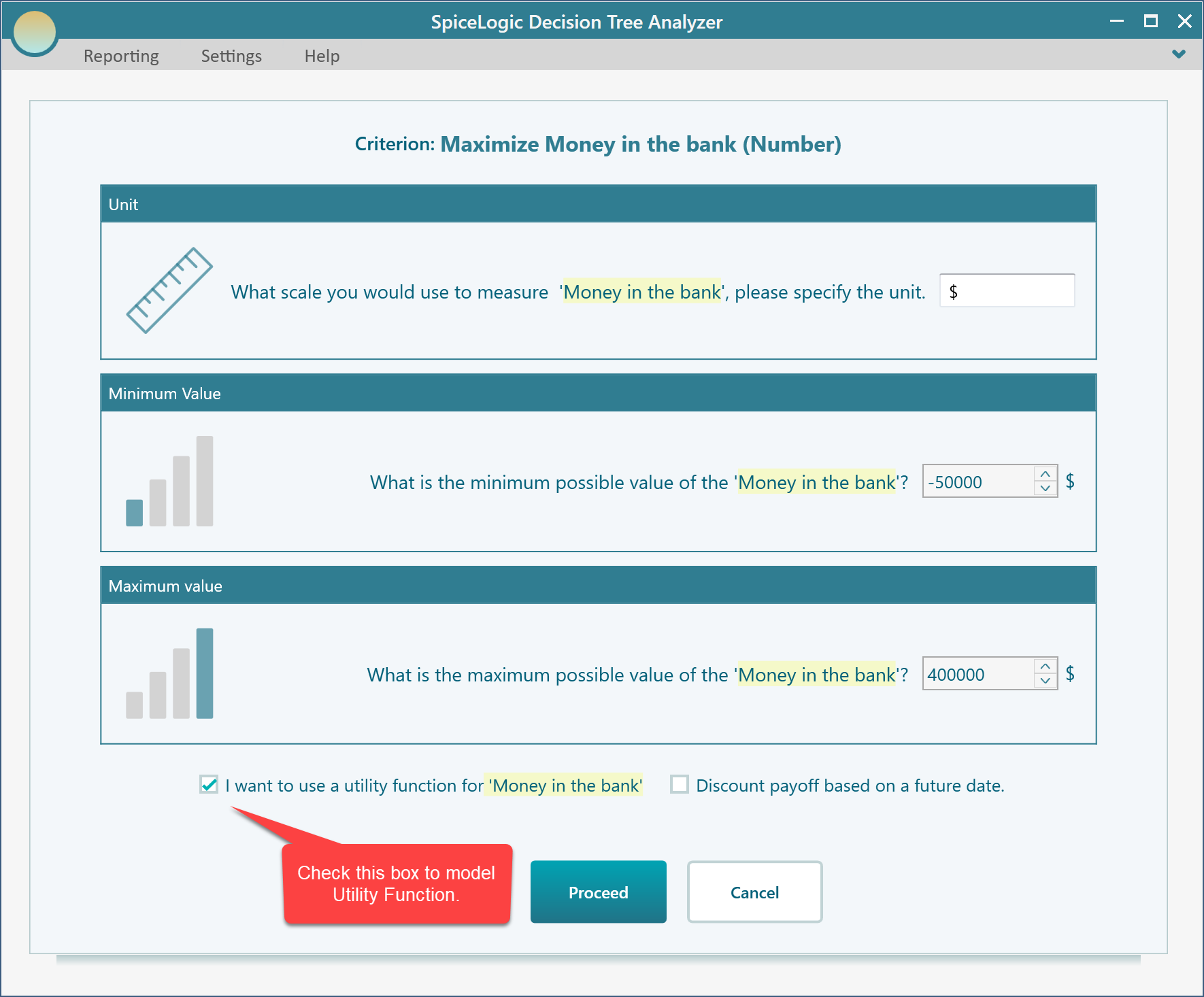

Certainty Equivalent Calculation Using Decision Tree

Home Oecd Ilibrary

Do Probability And Certainty Equivalent Techniques Lead To Inconsistent Results Evidence From Gambles Involving Life Years And Quality Of Life Sciencedirect

Certainty Equivalent Calculation Using Decision Tree

Certainty Equivalent An Overview Sciencedirect Topics

Game Theory Net Risk And Certainty Equivalent Applet

Risk Attitude Dr Yan Liu Ppt Video Online Download

Ppt Contemporary Financial Management Powerpoint Presentation Free Download Id 6521787

Microeconomics I How To Calculate The Certainty Equivalent Of A Gamble Youtube

Game Theory Net Risk And Certainty Equivalent Applet

Solved Consider A Lottery L Consisting Of Getting 0 With Chegg Com

Chapter 14 Risk And Uncertainty Managerial Economics Economic Tools For Today S Decision Makers 4 E By Paul Keat And Philip Young Ppt Download

Game Theory Net Risk And Certainty Equivalent Applet

How To Calculate Certainty Equivalent In Cash Flow Bizfluent

Certainty Equivalent Calculation Using Decision Tree

Certainty Equivalent Calculation Using Decision Tree

Mean Certainty Equivalents And Expected Values Download Scientific Diagram